Why Third-Party Integrations Drive SaaS Growth & Retention

AI

6 mins

Dec 19, 2025

Khyati Mehra

Modern software markets are hyper-specialized. Attempting to build every feature in-house is capital-intensive, slow, and distracts teams from their true differentiation. Third-party integrations offer a faster, more pragmatic path to market leadership by allowing companies to assemble best-in-class capabilities instead of reinventing them.

This modular, API-driven approach is especially powerful for AI MVP development. Startups can integrate foundation models, payments, analytics, or communication tools off-the-shelf, dramatically reducing time-to-market. Engineering effort is then concentrated where it matters most: building proprietary logic, domain expertise, and defensible data advantages.

Integrations shift product strategy from “feature completeness” to “ecosystem leverage.”

The Core Business Case for Integrations

From a business perspective, integrations are not a cost center—they are an investment in scalable growth. When executed strategically, they directly impact the most important SaaS metrics.

Lower Customer Acquisition Cost (CAC)

Integrations unlock partner-led distribution. When your product works seamlessly with tools already embedded in your customer’s workflow, you gain access to pre-qualified demand. Integrations reduce friction in sales conversations and shorten evaluation cycles.

Higher Lifetime Value (LTV)

A deeply integrated product becomes harder to replace. When customers rely on your software as part of a broader operational system, switching costs rise. This defensibility reduces churn and increases expansion potential.

Expanded Product Value Without Feature Bloat

Each integration extends your product’s functional surface area without requiring new core features. You solve adjacent problems without increasing product complexity or engineering burden.

A connected product is a defensible product. Ecosystems are significantly harder to replicate than features.

From Standalone Tool to Ecosystem Hub

The highest leverage integrations create compounding value. Each new connection increases the usefulness of the entire platform for all users. Over time, your product shifts from being “one of many tools” to the system customers organize their work around.

This is how category leaders emerge—not through isolated innovation, but by becoming the operational hub of their customers’ stack.

For founders, the question is not whether to invest in integrations, but how to architect an integration strategy that compounds over time rather than creating technical debt.

Quantifying the Business Impact of Integrations

The strategic case is compelling, but integrations ultimately must prove their value in measurable outcomes. For founders raising capital or defining a go-to-market strategy, this quantification is essential.

Well-executed integrations consistently drive improvements across revenue, retention, and sales efficiency:

Integrations influence a majority of B2B purchase decisions.

Integrated customers churn significantly less than non-integrated users.

Integration marketplaces accelerate sales by preemptively resolving technical objections.

In practice, integrations elevate software from a “nice-to-have” to an operational dependency.

How Integrations Drive Revenue and Retention

Higher ARPU: Premium integrations can be gated behind higher-tier plans. Customers operating in complex ecosystems are willing to pay for reliability and depth.

Lower Churn: Embedded workflows make replacement painful. Migration costs rise as integrations accumulate.

Shorter Sales Cycles: Supporting a prospect’s existing stack removes uncertainty and speeds up deal closure.

The ROI is not theoretical. Integrations directly influence CLV, CAC, NRR, and market expansion.

Building a Defensible Ecosystem

Beyond immediate financial returns, integrations create long-term competitive advantage. Each new connection strengthens the platform, attracting more users and more partners—a flywheel effect that compounds over time.

When third parties invest in building integrations with your product, they implicitly endorse it to their user base. This transforms integrations into a powerful, often underutilized acquisition channel.

At scale, competition shifts from feature comparisons to ecosystem depth. Platforms with stronger, more reliable integrations win.

Integration Architecture: From Strategy to Execution

Once the strategic case is clear, execution becomes the differentiator. Integration architecture is not a technical footnote—it determines scalability, reliability, and long-term velocity.

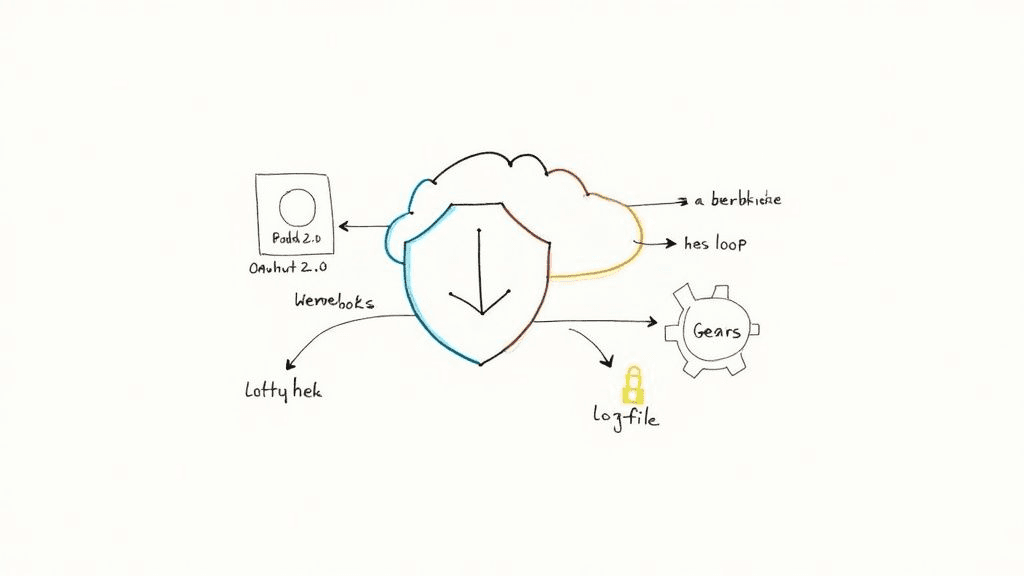

At the core of modern integrations are APIs, which act as formal contracts between systems. For real-time updates, webhooks replace inefficient polling by pushing events as they occur.

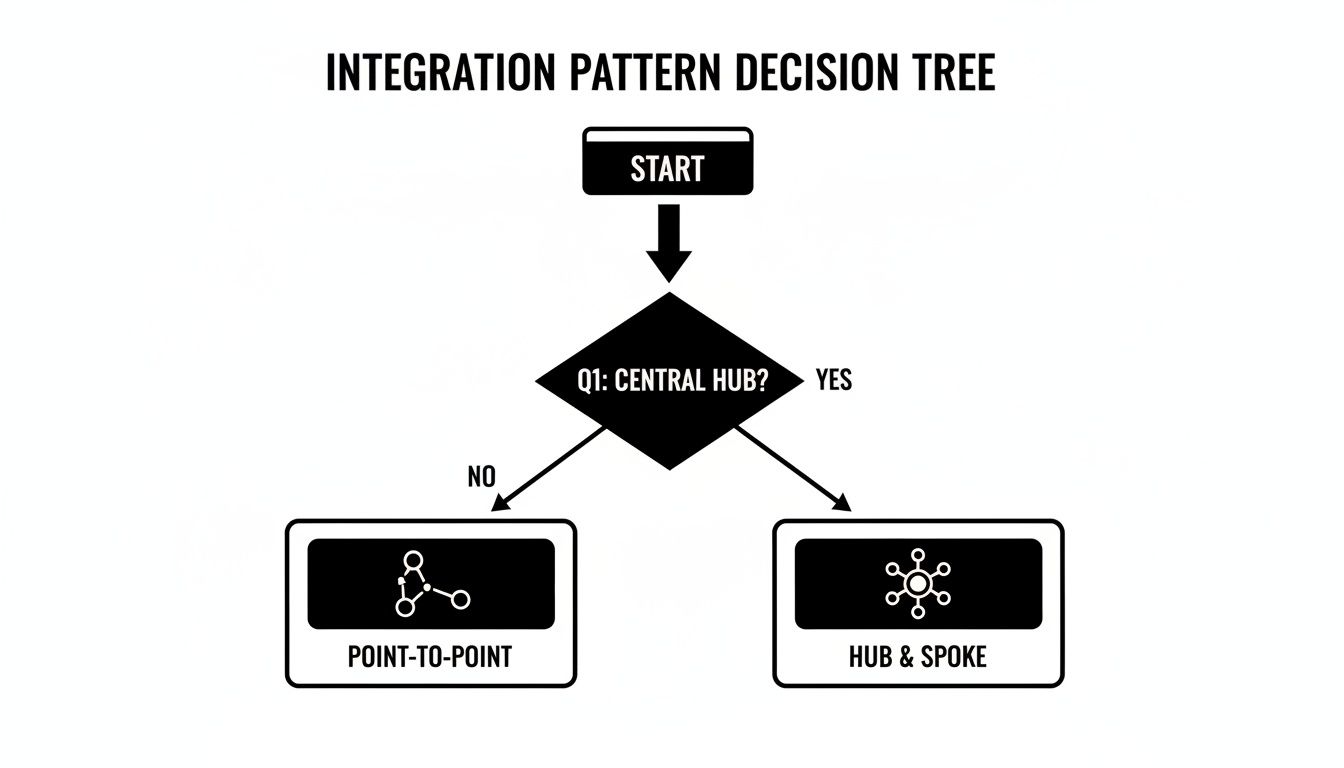

Choosing the Right Architecture Pattern

Point-to-Point Architecture

Each system connects directly to every other system. This is fast for early MVPs with limited integrations, but complexity grows exponentially. Over time, it results in fragile, hard-to-maintain “spaghetti architecture.”

Hub-and-Spoke Architecture

A centralized integration layer manages all connections, routing, and transformations. While it requires more upfront planning, it scales cleanly and reduces long-term maintenance.

For early AI MVPs, point-to-point may be acceptable. For any product with scaling ambitions, centralized integration architecture is inevitable.

Core Integration Technologies

REST APIs: The standard for synchronous integrations. Reliable, simple, and widely supported.

GraphQL APIs: Allow clients to request exactly the data they need, improving efficiency in complex systems.

Embedded iPaaS: Pre-built integration platforms that provide connectors, auth flows, and monitoring out of the box, enabling faster marketplace launches.

Technology choices should optimize for speed today without constraining growth tomorrow.

Build vs Buy: A Strategic Decision

Every team eventually faces the build-or-buy dilemma. This decision impacts engineering allocation, product velocity, and long-term costs.

Building in-house offers control and deep customization but requires ongoing investment in maintenance, monitoring, and security.

Buying or embedding platforms dramatically accelerate time-to-market and reduce operational overhead, at the cost of some flexibility.

A Practical Decision Framework

Core vs Context: If an integration is central to your differentiation, build it. If it’s table stakes, buy it.

Engineering Capacity: Integration maintenance is a hidden cost many teams underestimate.

Speed to Market: For MVPs and investor demos, breadth often matters more than depth.

Most successful teams adopt a hybrid approach: build what differentiates, buy the rest.

Technical Best Practices for Reliable Integrations

Execution quality determines trust. Poorly implemented integrations create support burden, security risks, and user frustration.

Security First

Use OAuth 2.0 for delegated access.

Encrypt and securely store API credentials.

Apply the principle of least privilege—request only what’s necessary.

Security failures in integrations expose the entire system.

Design for Failure

APIs will fail. Systems must anticipate this.

Provide clear, actionable error messages.

Implement exponential backoff for retries.

Use circuit breakers to prevent cascading failures.

Resilience is a feature users notice only when it’s missing.

Monitor Everything

Track latency, error rates, and rate-limit usage. Observability enables proactive fixes before customers are impacted.

The Future: AI-Driven Integrations

Integrations are evolving from passive data pipes into active intelligence layers. AI is accelerating this shift.

Integrations as Context for AI

Retrieval-Augmented Generation (RAG) relies on integrations to inject real-time, domain-specific data into models. This transforms generic LLMs into highly contextual, trustworthy systems.

AI Agents as Autonomous Operators

AI agents increasingly operate software directly via APIs—updating records, triggering workflows, and coordinating across tools without human intervention. Integrations become the action layer for intelligence.

This is not speculative. Many companies are already deploying agentic systems powered by integrations.

Why This Matters for Founders and Investors

The convergence of AI and integrations is redefining product defensibility. Algorithms can be replicated; proprietary data and deeply embedded workflows cannot.

A strong integration strategy is no longer optional—it is the foundation of scalable, intelligent software.

For AI MVPs, integrations validate market relevance, accelerate adoption, and create early defensibility. For investors, they signal maturity, pragmatism, and long-term leverage.

Key Questions Founders Ask

How do we choose integration partners?

Prioritize tools embedded in your customer’s daily workflow. Evaluate API quality, reliability, and ecosystem reach, not just brand recognition.

How do we measure success?

Track adoption rate, retention impact, and revenue contribution. Integrated users should be more valuable than non-integrated ones.

How do we manage security risk?

Least privilege, secure credential management, and continuous monitoring are non-negotiable. Over-permissioned integrations are a liability.

Final Takeaway

Third-party integrations are no longer auxiliary features—they are strategic infrastructure. They reduce acquisition costs, increase retention, accelerate sales, and form the backbone of intelligent, AI-driven products.

For startups pursuing rapid AI product acceleration, an integration-first mindset is not a luxury. It is a prerequisite for building software that scales, compounds, and wins.